To our friends, clients and colleagues in local and regional government, local and higher education, and the nonprofit sector, welcome to our latest Monday Message from the Public Law Group at McDonald Hopkins. In today’s email, assembled by attorney Kevin Butler, you’ll find insights into areas of law we’re watching on your behalf.

In today’s edition:

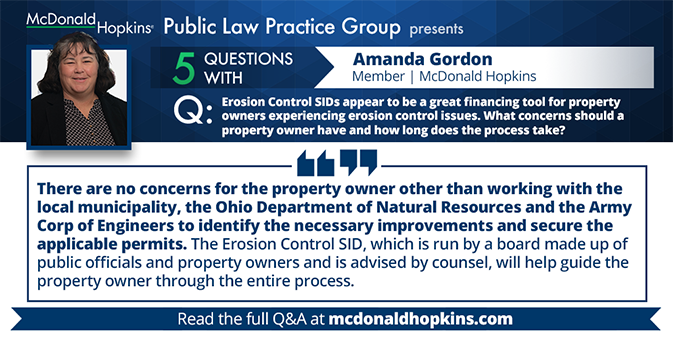

- Our monthly segment, ‘5 Questions With,’ featuring our own Amanda Gordon

- Columbus continues to debate pandemic-related income tax reform; Ohio cities push back

- Looking forward to receiving American Rescue Plan dollars? Attend this tutorial

- Upcoming MH events and webinars

In our monthly segment, ‘5 Questions With’ our own Amanda Gordon

In today’s edition of the Monday Message, we’re excited to continue our series, “5 Questions With” – a monthly segment in which we ask local, regional and statewide leaders to pass along their wisdom on items of current and lasting interest, all in a brief, easy-to-read format.

For our latest installment we’ve tapped into the wisdom of our own colleague, Amanda Gordon, a veteran public finance and public law attorney who has been featured in several media outlets recently on her leadership of our erosion control group, which is working with several communities along the Lake Erie shoreline to address the impact of wave action and rising water levels on lakefront properties. In our monthly segment Amanda explains the advantages property owners reap by participating in a new statutory vehicle – the shoreline special improvement district (SID) – which enables them to finance erosion control work via the special assessment process in an affordable and flexible way. “This procedure,” Amanda says, “allows for the property owners to finance the costs of the erosion control improvements over a longer period of time as well as at a lower interest rate than they would likely be able to obtain in a traditional personal financing.” She also hints at our efforts to expand erosion control SIDs to cover properties along inland waterways.

Read more from Amanda here – and also mark your calendars for Wednesday, June 9, at noon, when Amanda and others in our group will be featured in a McDonald Hopkins-hosted webinar that covers how erosion control SIDs work. Stay tuned for more details here in the Monday Message and by email.

Columbus continues to debate pandemic-related income tax reform; Ohio cities push back

As we’ve reported recently, Ohio lawmakers are considering whether to roll back a portion of the state’s 2020 legislation that preserved the status quo for municipalities collecting income tax from employees whose usual commutes into work have become telecommutes due to the pandemic.

At issue is H.B. 157, which is currently pending in the Ohio House’s Ways and Means Committee and whose latest substitute under committee consideration would allow employees forced to work from home to seek refunds from their employer city dating back to the beginning of the crisis. That has met strong opposition from entities like the Ohio Municipal League and the Ohio Mayors Alliance, which represent cities and villages statewide and which portend enormous financial peril if the measure succeeds. “Municipalities across the state have made budgetary decisions that are dependent upon the revenue stability granted to them by [last year’s status quo legislation],” wrote Ashley Ringle of OML, in opponent testimony last week. “Issuing refunds for a closed tax year could be devastating to municipalities … and could have long lasting negative consequences to the financial solvency of municipalities, existing economic development incentive agreements and decreased bond ratings, just to name a few.”

We will continue to provide updates on H.B. 157 and its companion legislation, S.B. 97, which has not yet had a committee hearing, in future editions of the Monday Message.

Looking forward to receiving American Rescue Plan Act dollars? Attend this tutorial

While we await guidance from the U.S. Treasury Department on on appropriate uses of American Rescue Plan Act dollars, President Biden’s $1.9 trillion economic stimulus package, Ohio local governments can benefit from a webinar series to begin this week that will assist in answering questions.

This Thursday, April 29 at 1:30 p.m., Ohio’s Office of Budget and Management will begin the webinar series by educating local government officials on what to do to prepare for receipt and expenditure of these funds, how to report use of funds, and how this year’s stimulus revenue will interact with local governments’ obligations with respect to Coronavirus Relief Act monies arriving in 2020. Additionally, OBM will discuss relief found in Gov. DeWine’s biennial budget. Register here. The next two OBM webinars in the series will be held on May 18 and June 24.

Upcoming MH events and webinars

A series of upcoming online McDonald Hopkins events targeted to those across a broad array of industries may appeal to you.

On Thursday, May 6 at noon, we’ll present What to do When OSHA Appears: What you Need to Know to be Prepared, aimed at preparing you and your organization for an impromptu visit by an OSHA safety officer and ensuring you have plans in place on how to handle those situations. Register here.

On Wednesday, May 19 at noon, our Public Law team will produce the first of several periodic webinars that explore topics of interest to the readers of the Monday Message, some offering continuing education credit. In this first installment, leading MH employment and public law attorneys will discuss employer vaccination plans and protocols in the government, education and nonprofit sphere. Is mandatory employee vaccination necessary for a successful, fully integrated reopening? Is mandatory vaccination lawful? A link to register will be forthcoming in future editions of the Monday Message; for now, mark your calendars. (Also note our second installment, the June 9 webinar on shoreline erosion control special improvement districts discussed above.)

Feel free to contact any member of the McDonald Hopkins Public Law team if you have questions or need assistance on any of the matters we’ve covered above or with your legal needs in general.

Teresa Metcalf Beasley

Chair, Public Law