To our friends, clients and colleagues in local and regional government, local and higher education, and the nonprofit sector, welcome to our latest Monday Message from the Public Law Group at McDonald Hopkins. In today’s email, assembled by attorneys Teresa Metcalf Beasley, Dave Gunning and Kevin Butler, you’ll find insights into areas of law we’re watching on your behalf.

In today’s edition:

- ‘5 Questions With’ Robert Sprague, Ohio Treasurer of State

- Ohio public colleges and universities wrestle with mask and vaccination decisions

- Legislature expands tax-increment financing options for municipalities

- Supreme Court pinpoints beginning of 30-day window for perfecting administrative appeals

- Replay our Public Law in Practice cybersecurity webinar

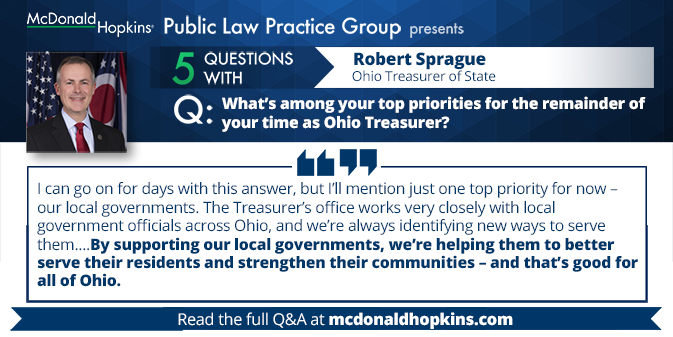

‘5 Questions With’ Robert Sprague, Ohio Treasurer of State

In today’s edition of the Monday Message, we’re excited to continue our series, “5 Questions With” – a monthly segment in which we ask local, regional and statewide leaders to pass along their wisdom on items of current and lasting interest, all in a brief, easy-to-read format.

For our latest installment we’re pleased to feature the words and wisdom of Ohio Treasurer of State Robert Sprague, who’s served in that esteemed role since his election in 2018. In today’s segment Treasurer Sprague looks back to survey his accomplishments to date – not least of which is the pay-for-success ResultsOHIO public-private partnership program, which has now seen its first fully funded project take off in the state’s Appalachian region – and his image for his office’s future success. Of interest to our readers: He’s launched regional advisory boards consisting of officials that will help him serve local governments. He introduced a new program that will provide reduced-interest loans to families involved in adopting children. And he’s grown the success of the state’s STABLE account program – a pretax savings tool for disabled individuals. “Since the start of 2019,” he writes, “we’ve seen the program grow from fewer than 10,000 accounts to the nearly 25,000 active accounts there are today.”

Read more insights from Sprague here.

Ohio public colleges and universities wrestle with mask and vaccination decisions

Our partner Dave Gunning, the chairman emeritus of Cleveland State University’s board of trustees and a person closely connected with higher education in the state, writes today that Ohio’s public colleges and universities have for the most part decided to combat the rise of Covid’s Delta variant by requiring some form of mask mandate.

“Ohio State is requiring all students to wear masks inside all school buildings,” Dave reports. “Further, students who have not been vaccinated must wear masks at all times.”

He says this seems to be the running theme among the colleges and universities. “Cleveland State University is requiring all students who are living in the dormitories to have been vaccinated. Only a few small schools are not requiring masks. Most recognize that to keep their school operating with some degree of normalcy that some type of mask mandate, at least for inside, is the responsible course of action.”

On vaccines, Dave looks with a weather eye toward the Pfizer vaccine and others receiving full FDA approval, and how those approvals may change schools’ positions for students living on campus. “One of the arguments used to not get the vaccine has been the lack of full FDA approval,” Gunning says. “In fact, the Ohio legislature passed a couple of months ago a law, effective in October, that would prevent universities and colleges from forcing masks in dorms, unless the vaccine had received full approval. Now that Pfizer is getting full approval and Moderna is not far behind, the Ohio schools will have more support to require students to be vaccinated before living on campus.”

We continue to monitor the legal implications of masking and vaccination debates affect public, education, nonprofit and other private employers statewide and nationwide. “Hopefully,” Dave says, “with FDA approval more students will get vaccinated and the debate will quiet down.”

Legislature expands tax-increment financing options for municipalities

Our partner Teresa Metcalf Beasley, a veteran public finance attorney, reports that the most recently passed budget bill, H.B. 110, included several favorable amendments to the tax increment financing incentives granted under Section 5709.41(D) of the Ohio Revised Code. The amendments provide a bit more flexibility for municipalities passing TIF ordinances, offering several options to determine the effective date of the tax exemption as set forth in the authorizing ordinances:

- The tax exemption can commence with the tax year specified in the ordinance so long as the year specified in the ordinance commences after the effective date of the ordinance.

- If no year is specified or a year prior to the effective date of the ordinance is stated, then the tax exemption commences the date the exempted improvement first appears on the tax duplicate after the effective date of the ordinance.

- The value of the exempted improvement rather than a tax year is used to determine the effective date of the of the tax exemption.

- If multiple parcels are subject to the TIF ordinance, the ordinance can determine the effective date of the TIF exemption by parcel.

These amendments to R.C. 5709.41 are in alignment with the requirements of tax exemptions permitted under R.C. 5709.40, which was also amended to expand the definition of “public infrastructure improvement” to include “off-street parking facilities,” giving municipalities clear authority to participate in projects involving structured parking.

As municipalities continue to look for creative economic development tools to finance economic development projects, these amendments as well as others included in H.B. 110 provide more flexibility for municipalities with respect to tax increment financing. Contact Teresa Metcalf Beasley or Amanda Gordon for more on these changes.

Supreme Court pinpoints beginning of 30-day window for perfecting administrative appeals

Last week the Ohio Supreme Court issued an opinion that provides clearer guidance on when the 30-day window within which to perfect an appeal to common pleas court from a decision of an administrative body (such as a civil service commission, board of zoning appeals, etc.) begins to run. In State ex rel. Cox v. Youngstown Civ. Serv. Comm., 2021-Ohio-2799, the court held that the appeal period from a decision of the Youngstown Civil Service Commission under Chapter 2506 of the Revised Code began to run on the date the commission approved the minutes of the meeting at which it made its final decision, and not some later date. The court failed to give quarter to the aggrieved employee notwithstanding the fact that the employee was never notified of the commission’s final action, even despite commission rules requiring such notice.

Deadlines for perfecting administrative appeals can sometimes vary depending on the customs of the administrative body, but calendaring appropriately is crucial to either avoiding dismissals as an appellant or seeking dismissals as an appellee. Contact Kevin Butler or any of our Public Law team for advice, guidance and advocacy in any administrative appeal setting.

Replay our Public Law cybersecurity webinar

Missed the third installment of our Public Law in Practice seminar series? Not to worry: Replay the hourlong August 3 webinar here, where you’ll hear from moderator Teresa Metcalf Beasley, our litigation colleague Robert Cohen and our data privacy and cybersecurity colleague Amanda Martin. Together they formed an expert panel and provided proactive, practical, step-by-step tips to help you navigate your risk when it comes to wire fraud and ransomware attacks, which are often geared toward public entities and smaller organizations unready to handle them.

Feel free to contact any member of the McDonald Hopkins Public Law team if you have questions or need assistance on any of the matters we’ve covered above or with your legal needs in general.

Teresa Metcalf Beasley

Chair, Public Law