|

To our friends, clients and colleagues in local and regional government, higher education and the nonprofit sector, welcome to our latest Monday Message from the Public Law Group at McDonald Hopkins. In today’s email, assembled by attorneys Kaitlin Corkran, David Gunning, Kelsey Smith and Kevin Butler, you’ll find insights into areas of law we’re watching on your behalf.

In today’s edition:

- Introducing our monthly segment, ‘5 Questions With’

- Spotlight on economic development tools: Packaging incentives

- Update on legislation, litigation challenging HB 197 income tax provisions

- Problem Solvers Caucus nudges Congress toward bipartisan relief package

- A moment of remembrance

Introducing our monthly segment, ‘5 Questions With’

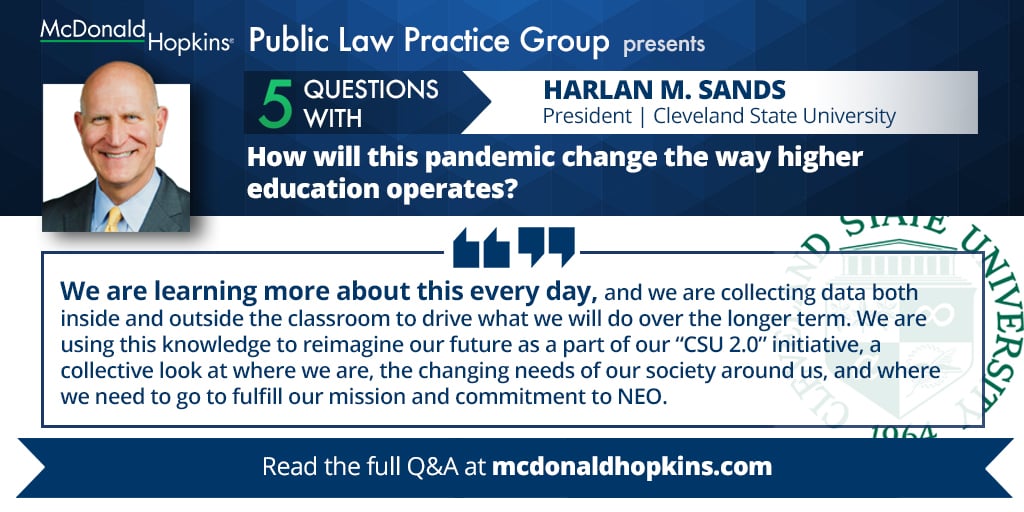

In today’s edition of the Monday Message, we’re excited to introduce “5 Questions With” – a monthly segment in which we’ll ask local, regional and statewide leaders to pass along their wisdom on items of current and lasting interest, all in a brief, easy-to-read format.

For our inaugural installment we’ve asked Harlan M. Sands, the president of Cleveland State University, to guide us through his thoughts on preparing his campus for a return to class – and shaping the mindsets of his students, faculty and staff. For instance, we asked Sands how CSU has helped the outside community during the pandemic. His response? “By being a University that … has helped convince our community it is safe to come back downtown, it is safe to be in our campus buildings, and it is healthier for all of us to have college kids engaged and back in classrooms.”

The focus of our first installation of "5 Questions With" may be higher education, but the themes are universal to those across education, the nonprofit world, and state, regional and local government. Read Sands’ answers to our first five questions – plus a bonus question for good measure – here.

Spotlight on economic development tools: Packaging incentives

McDonald Hopkins is fortunate to count among our ranks an entire team of attorneys who have spent their careers helping government, education, and nonprofit entities employ special mechanisms to provide creative and cost-effective solutions for economic development projects and preserve clients’ bottom lines. In this Monday Message, we will highlight some of these financing vehicles waiting to be deployed.

The packaging of economic development incentives is the key. Like any package, incentives should fit the project and the partners, they should be timely, and they should complement any other resources brought to bear. High-impact projects often utilize a number of economic development tools, receiving incentives from the local, state, and/or federal government, as well as support from nonprofit organizations. In Ohio, projects may receive a TIF or tax abatement, job creation tax incentives and a grant from local government, lease conduit financing from the port authority, PACE financing, a grant or loan from JobsOhio, as well as a grant or loan from a nonprofit organization. Additionally, if the project involves a historic structure or is located within an opportunity zone or new markets census tract, it may qualify for federal tax incentives. Clear understanding of the available economic development tools and how they can work together is essential to packaging incentives for attraction and support of high-impact projects.

The economic development tools and resources are available to help finance high-impact projects in this challenging economic environment and these programs are eager to usher good projects across the goal line now more than ever. McDonald Hopkins’s Public Law team is highly skilled in economic development work and deeply experienced advising both public and private clients in packaging economic development incentives.

In upcoming editions of the Monday Message, we will discuss JobsOhio incentives, Opportunity Zones, and PACE financing in more detail. Meanwhile, contact Kaitlin Corkran or any of us on the Public Law team for assistance.

Update on legislation, litigation challenging HB 197 income tax provisions

We wrote on August 17 about a lawsuit and, separately, an effort in the Ohio General Assembly to undo the state law passed in March that preserved the status quo with regard to municipal income taxes collected from those working from home during the coronavirus pandemic. Today we provide a brief update.

Recall the provision in H.B. 197 that makes, during the coronavirus pandemic, the city in which an employer is located the usual place of employment for those telecommuting during the pandemic, notwithstanding that employees are performing their work from home. A July lawsuit filed by the Buckeye Institute in Franklin County against the City of Columbus is attempting to undo that law on due-process grounds, claiming that income tax withholdings must bear a relationship to the city in which the work was performed. Similarly, S.B. 352 (introduced August 11) and H.B. 754 (August 31) each attempt to repeal the portion of H.B. 197 dealing with municipal income taxes. Together, the litigation and bills cast into doubt whether Ohio’s hubs of employment will be able to retain the income taxes they’ve collected from work-from-home employees during the shutdown. It’s a question worth millions of dollars to municipalities statewide.

Since we last wrote, S.B. 352 has been referred to the Senate’s local government committee and awaits its first hearing on September 22, while H.B. 754 has not been sent to a committee at this point. We’ll provide updates on each of these measures when we learn more. Meanwhile, Columbus has moved to dismiss the Buckeye Institute’s lawsuit, claiming the General Assembly was within its constitutional and statutory right to provide for the temporary adjustment to usual withholding rules, and the Buckeye Institute has responded to the motion. The court has yet to rule, but we’ll stay vigilant and debrief you here on the status of the case.

Problem Solvers Caucus nudges Congress toward bipartisan relief package

President Trump recently suggested the House and Senate should continue work toward a pandemic relief package that meets somewhere in the middle, after months of partisan standoff between the two chambers. As our team member Kelsey Smith writes in a blog post, the president’s pitch follows the bipartisan congressional Problem Solvers Caucus’s introduction of a stimulus framework called the “March to Common Ground.” The proposed relief package would include COVID-19 testing, unemployment insurance, additional direct stimulus to Americans, worker and liability protection, small business and nonprofit support, food security, schools and child care, housing, election support, and state and local aid. Read more here and stay tuned to the Monday Message for updates as these discussions in Washington progress.

A moment of remembrance

With the passing of Justice Ruth Bader Ginsburg we celebrate the life and mourn the loss of a legendary and tenacious woman and jurist. Justice Ginsburg ignited a spark that will inspire future generations to continue her legacy of breaking down barriers and fervently fighting for equality among all people. We venerate her and we remember her today.

If you have questions or need assistance on any of the matters we’ve covered above or with your legal needs in general, please feel free to contact any member of the McDonald Hopkins Public Law team.

Have a great week!

Teresa Metcalf Beasley

Chair, Public Law

|